How SFT Android MPOS work with MobiTAX Light Electronic Billing Machine (Light EBM) System. Here below is a document which presents and combines MobiTAX Light EBM documentation aligning with Rwanda Revenue Electronic Billing Machine certification requirements for administrative review.

MobiTAX Light EBM

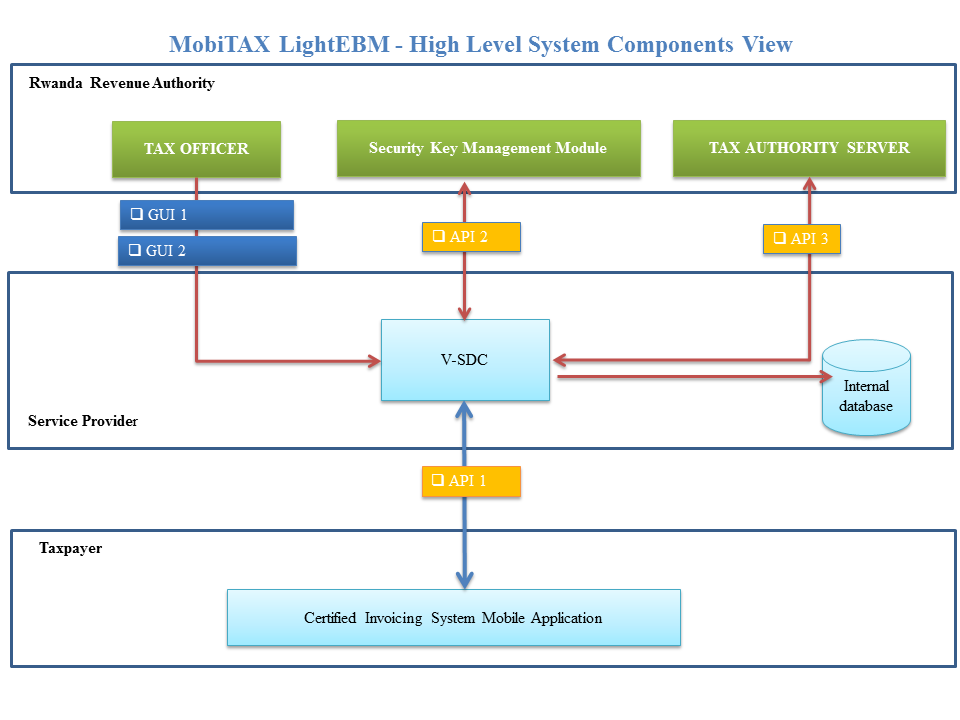

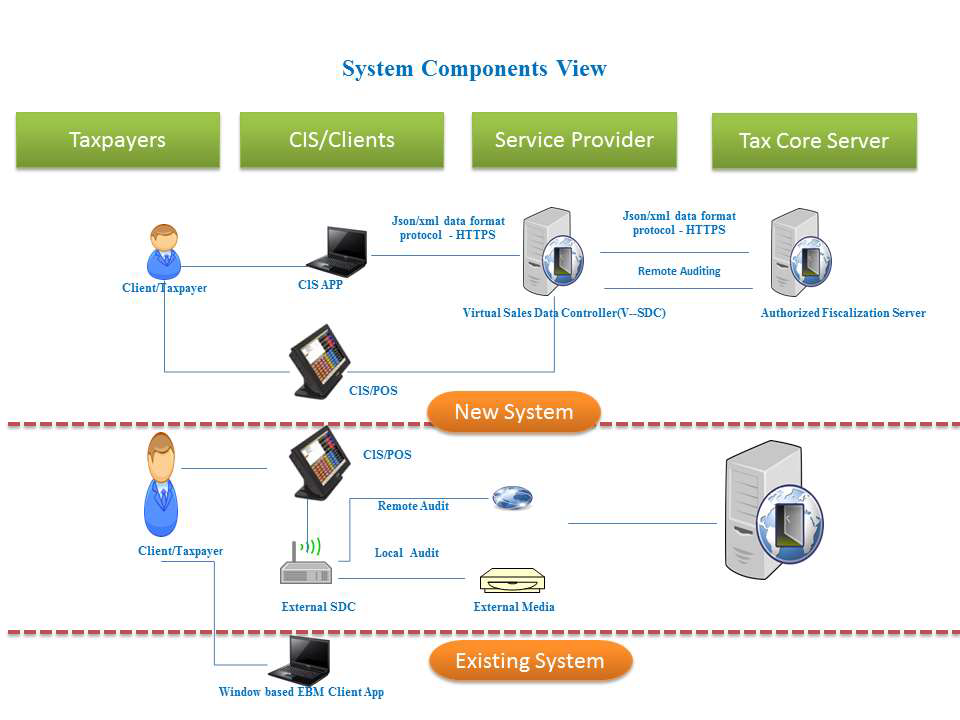

Light EBM is system consisting of Electronic Invoicing Manager (EIM) Android Mobile Application and Virtual Sales Data Controller Web Server. The EIM mobile app accesses MobiTAX VSDC web server via internet connection.

Light EBM Components

Electronic Invoicing Manager application is a point of sale (POS) mobile application that

runs from android pos machine or smartphone devices. The EIM application connects to

MobiTAX VSDC web service to report, sign sales data, and issue a certified receipt in

real-time.

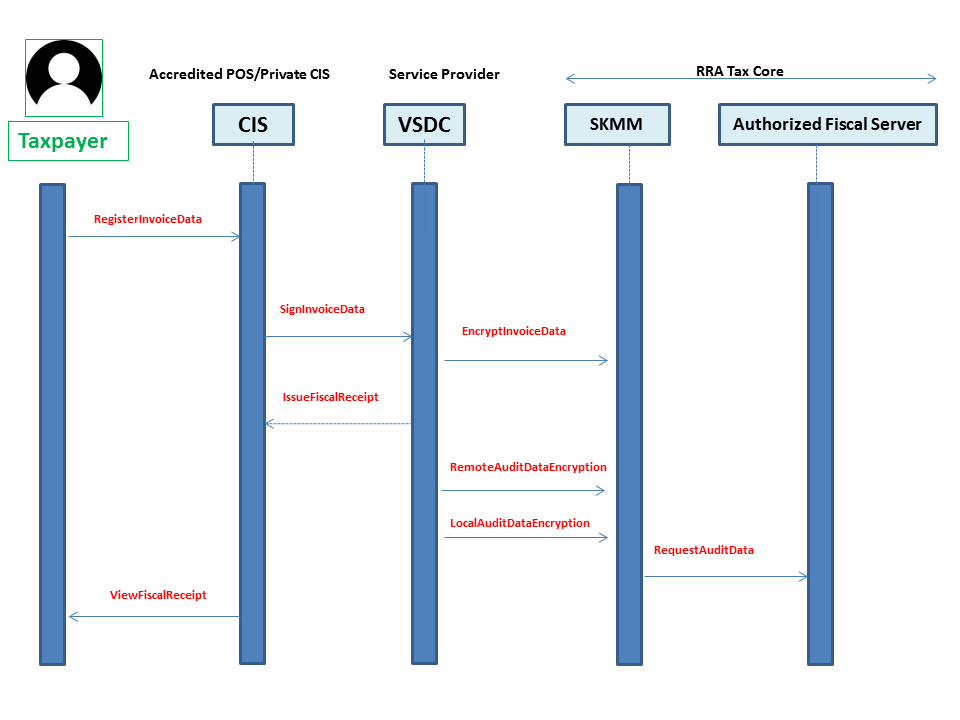

MobiTAX Virtual Sales Data Controller (VSC) is a web server application that extends

web services (API 1 and 3) to both electronic invoicing manager mobile applications for

collecting and generation of sales data receipts and Rwanda Revenue Authority server

for real-time sales reporting as well as remote auditing. More importantly, upon each

sale transaction log, MobiTAX VSDC makes an API call to MobiVAT which is a VAT split

payment gateway. Given a receipt total amount, MobiVAT instantly splits the amount in

terms of VAT and NET amount and remits it to the tax authority bank account and

taxpayer bank account respectively.

Security Key Management Modules (SKMM) is a security module to provide encryption

service in form of receipt signature for data integrity and authenticity through a web

service (API 2) call initiated from the MobiTAX VSDC.

Graphical User Interface GUI 1 and 2 are respectively to be used to remotely or locally

check MobiTAX VSDC local or remote audit and status.

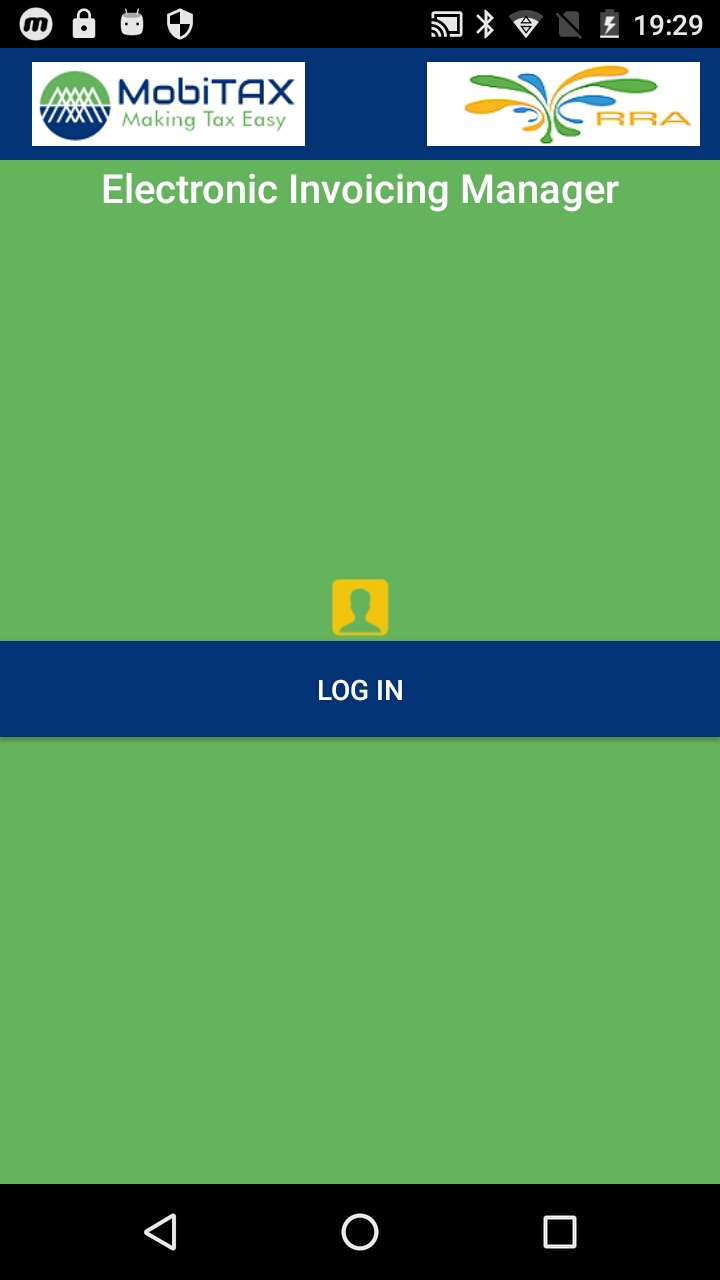

Electronic Invoicing Manager

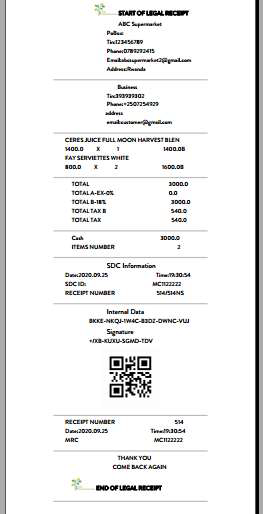

The EIM mobile app is tailored to support efficient management controls of point of sales in conformity with the requirements specified by the Rwanda Revenue Authority. The EIM application is an electronic invoicing mobile application which is intended to seamlessly andeasily support taxpayers (both non-VAT and VAT registered) to issue a simplified, certified, and verifiable receipt at a taxpayer’s point of sales using an android smartphone or any other android compatible point of sale device.

The EIM application generates a non-itemized certified retail receipt with total cost and merchant business category or one single and broad classification of merchant services and goods upon each sale transaction for the provision of services provided to the customer. In substitute for issuing an itemized bill listing the cost and details of each item purchased, Light

EBM assigns the merchant/taxpayer category or classification codes to broadly describe and map a set of consumer’s purchased items, goods, and services to a single type of goods or services that the taxpayer’ business provides. For value added tax accounting, a configurable vat percentage to be levied is predetermined (for instance 18%) is calculated based on the total receipt amount for VAT declaration and payment collection as per Tax Authority jurisdiction.

User Manual: Step 1: Using 4G Big Battery Android Lottery POS Terminal with Printer model

SF5502, An EIM Mobile App user/taxpayer download and install and launches the app.

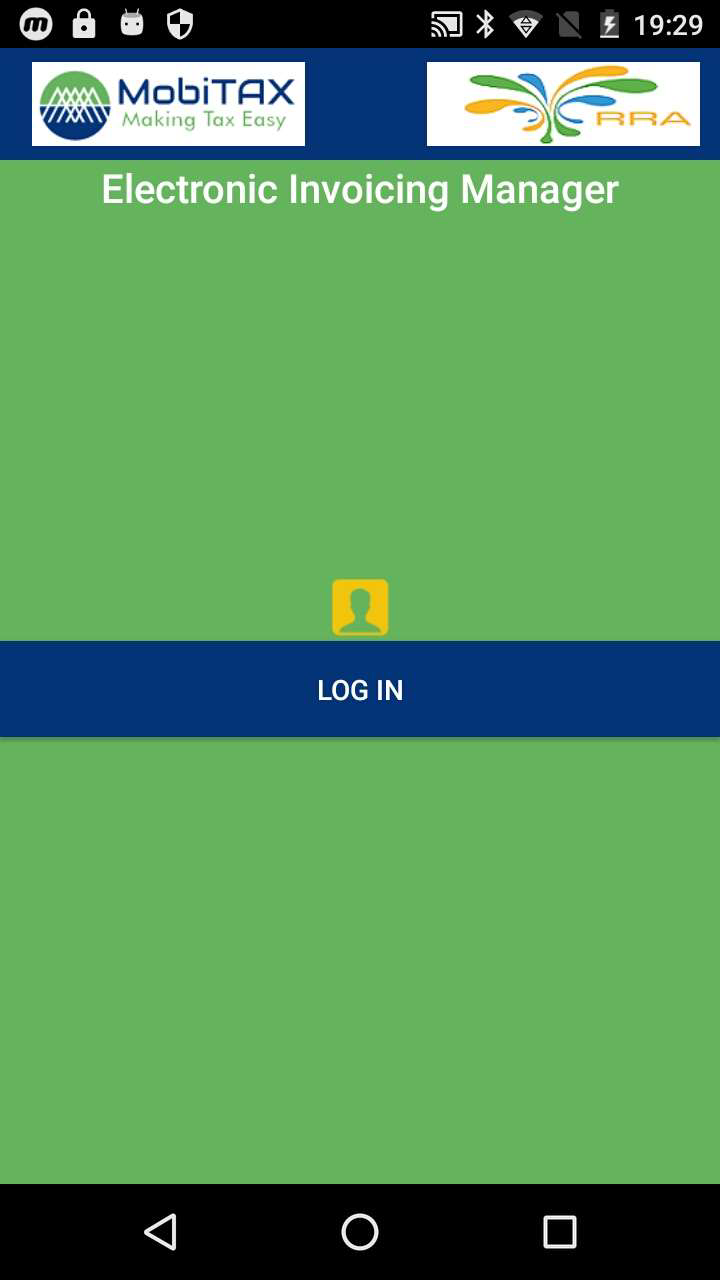

Step II. The EIM app displays log-in screen.The Taxpayer/User clicks on log in button to login.

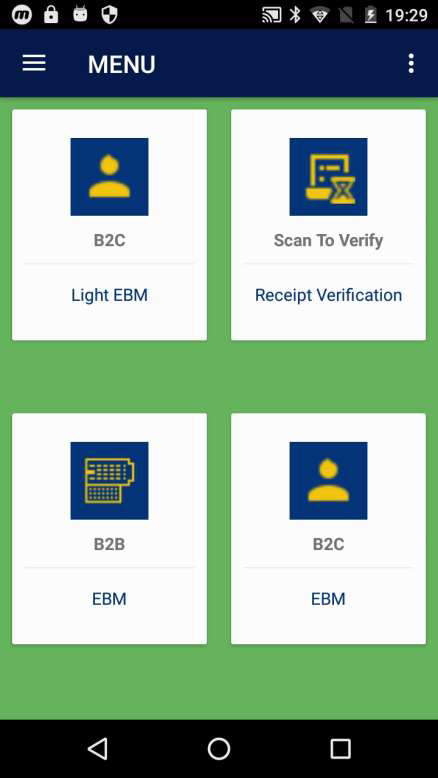

Step 3: The EIM app displays main menuscreen. And the taxpayer or user hit Light EBM menu

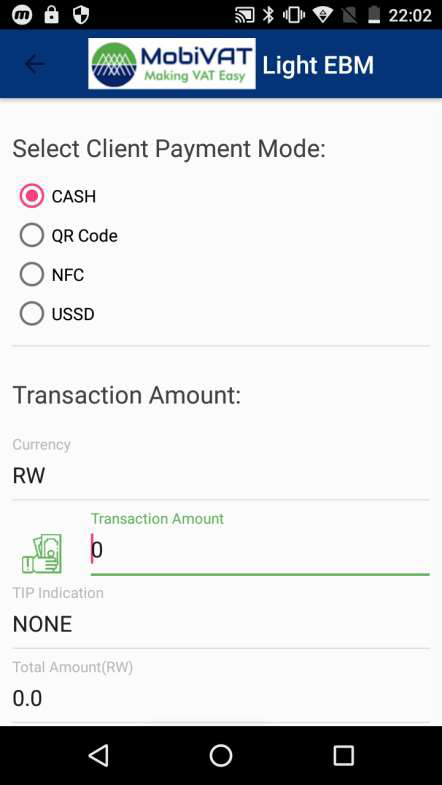

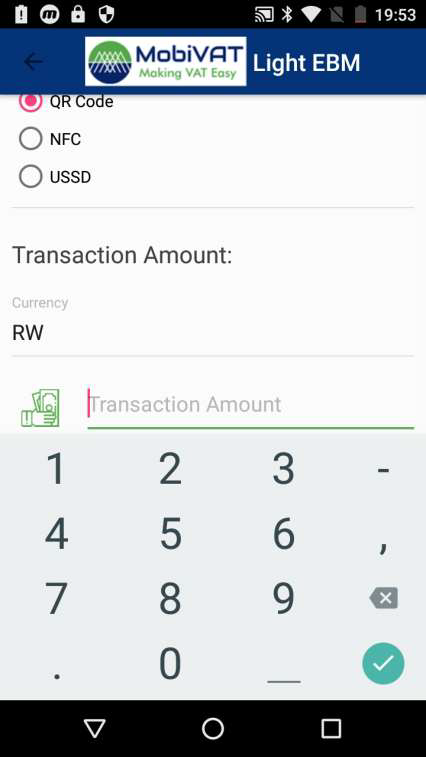

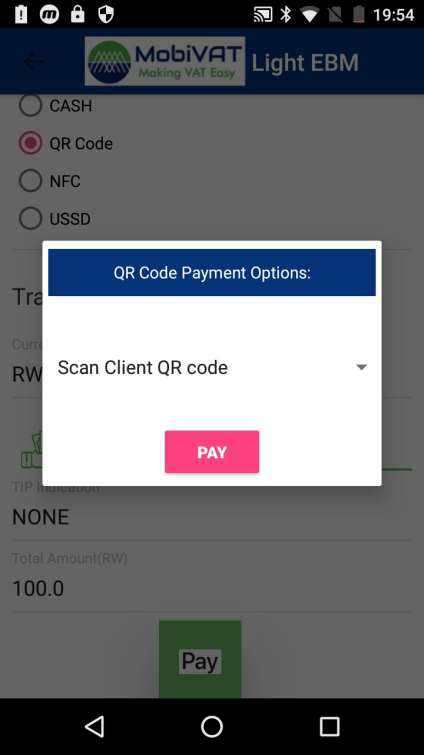

Step 4 The EIM app displays Light EBMScreen. The Taxpayer select client payment options (Cash, QR Code, or NFC). When aselected client payment mode is CASH, the taxpayer enters the total receipt amount of

all purchased item(s) then hit pay.

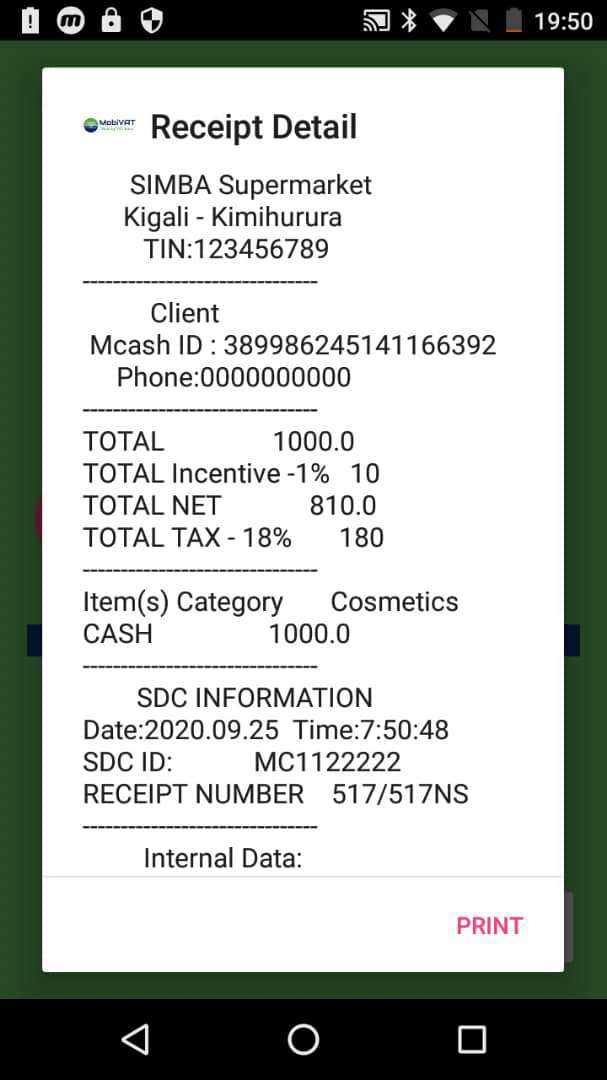

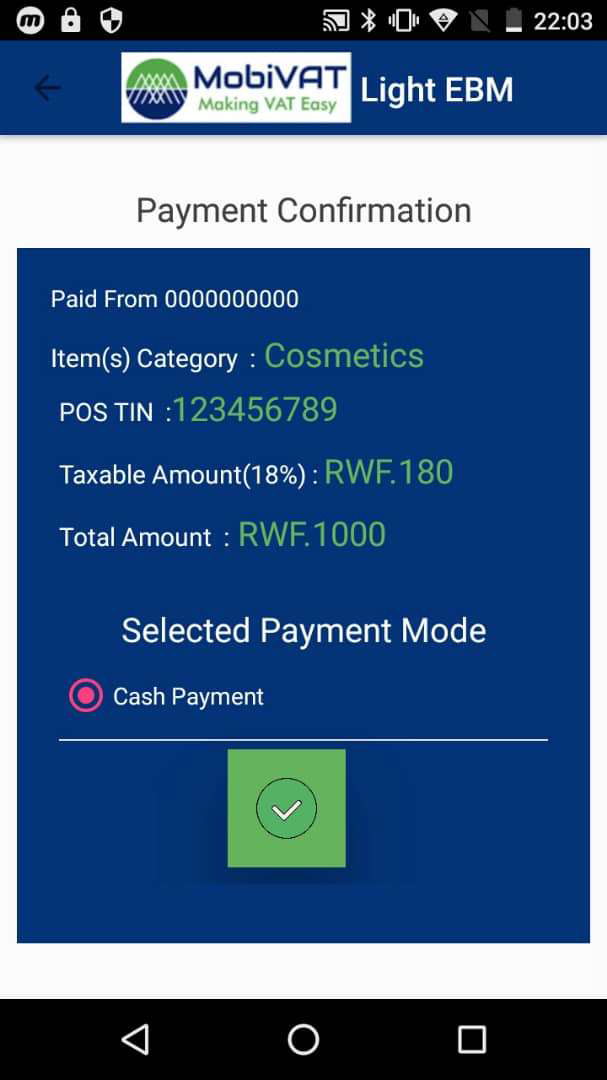

Step 5: The app displays receipt details item(s) or merchant business category POS TIN, taxable amount, and total receipt amount and the taxpayer confirm fiscal receipt generation request.

Step 6: For receipt generation the merchant category code (for instance cosmetics or 5411 for grocery stores and supermarkets category is used instead of itemizing all purchased items details on the receipt) and the receipt total amount, VAT amount to be levied, taxpayers and client details constitute only one receipt item

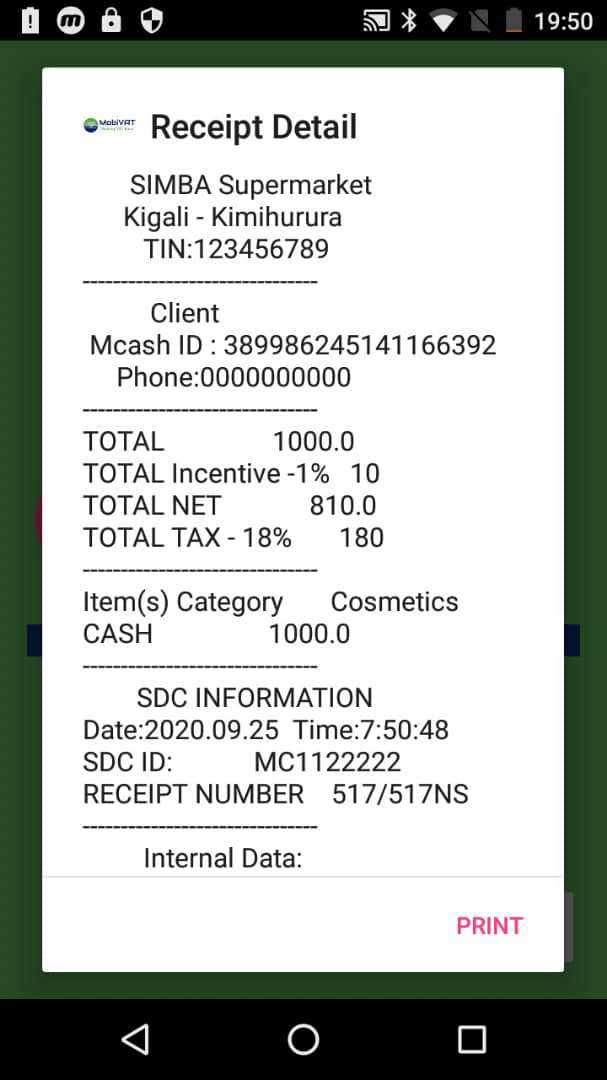

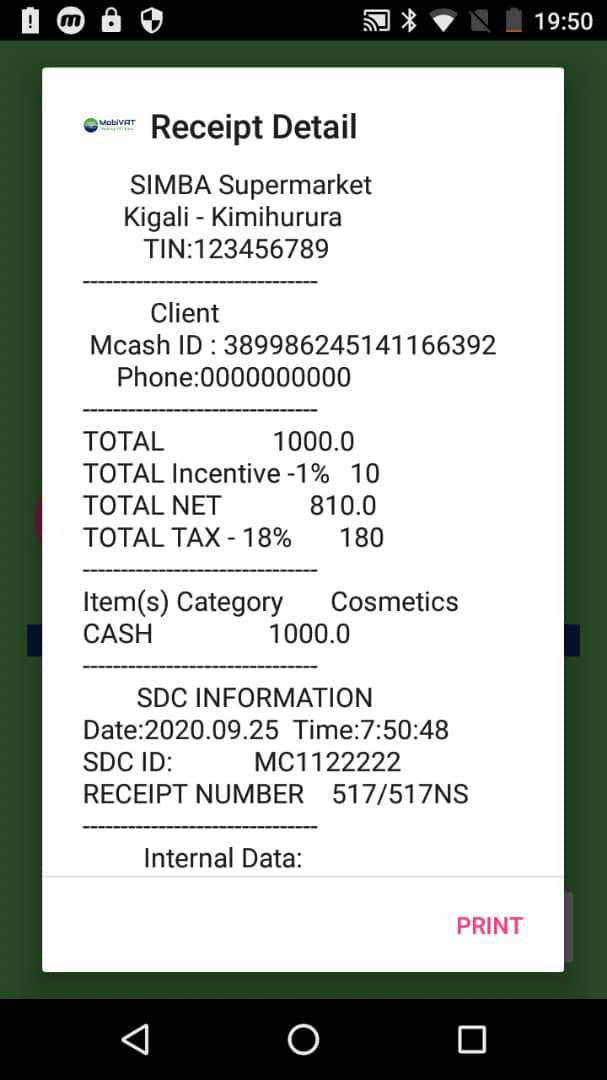

whose data is sent to the MobiTAX VSDC for validation and encryption to generate a certified fiscal and RRA compliant receipt.After MobiTAX VSDC receipt response payload, the EIM app display a certified receipt details which include the receipt counters, signature, internal data, qr code,timestamp, mrc, total amount , and vat

amount. To print the receipt, the use hit print button to initiate receipt printing.The triggered receipt payment happens by moving funds from Mobicash consumer wallet account to Mobicash Merchant wallet account for the receipt NET amount.The VAT amount is instantly declared and paid from Consumer Wallet account to RRA

account. As another option, a consumer incentive management module is initiated to account for a configurable incentive percentage which saved to registered consumer public social security account like

Ejo Heza fund.

Step7 : The EIM app prints out the certified fiscal receipt.

Step 8:Back to Step IV, when a selected client payment mode is QR Code. The app requests the taxpayer/user to specify if the payment is to be client initiated or merchant or taxpayer initiated.

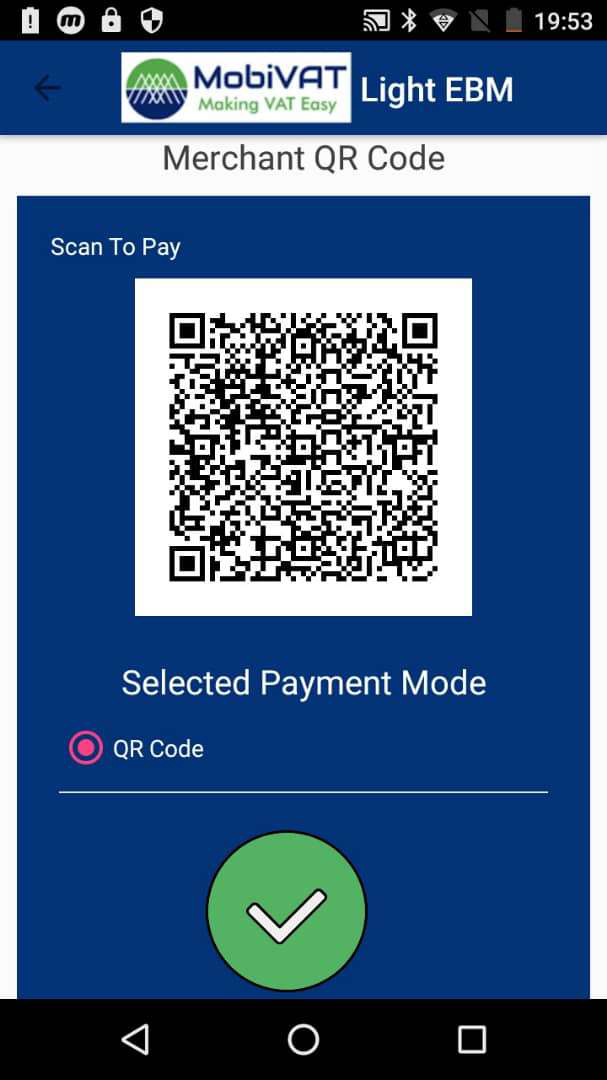

Step9: In case of client initiated payment,the client is to scan the merchant QR code and EIM app generates dynamic merchant/taxpayer QR code.

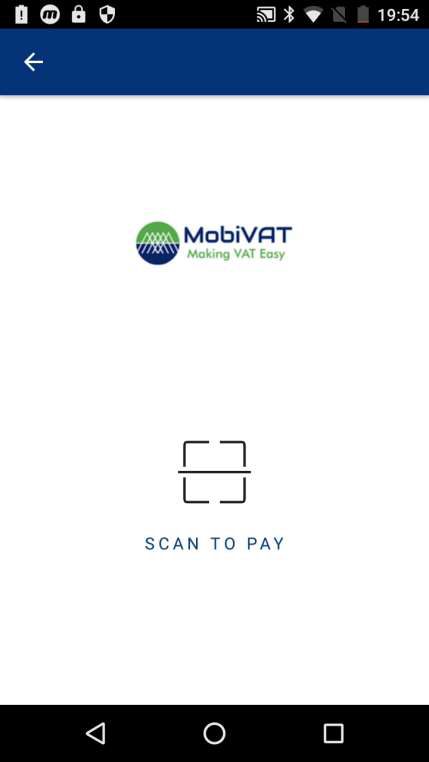

Step10: In case of merchant initiated payment, the merchant /taxpayer scans client QR code and request the client /consumer to authorize the transaction by entering the PIN. In this case the client is using Mobicash Consumer app to initiate a QR Code based payment by scanning EIM generated merchant QR code.

3G Big Battery Android Lottery POS Terminal with Printer model SF5502

MobiTAX Virtual Sales Data Controller

MobiTAX virtual sales data controller is a web server application that only interconnects with EIM app and tax revenue authority server through web services for real-time receipt reporting from EIM app to Tax core server.

For more information, you may send request to support@smartfeigete.com